Frost Pllc - Truths

Table of ContentsGet This Report about Frost PllcFrost Pllc for Dummies

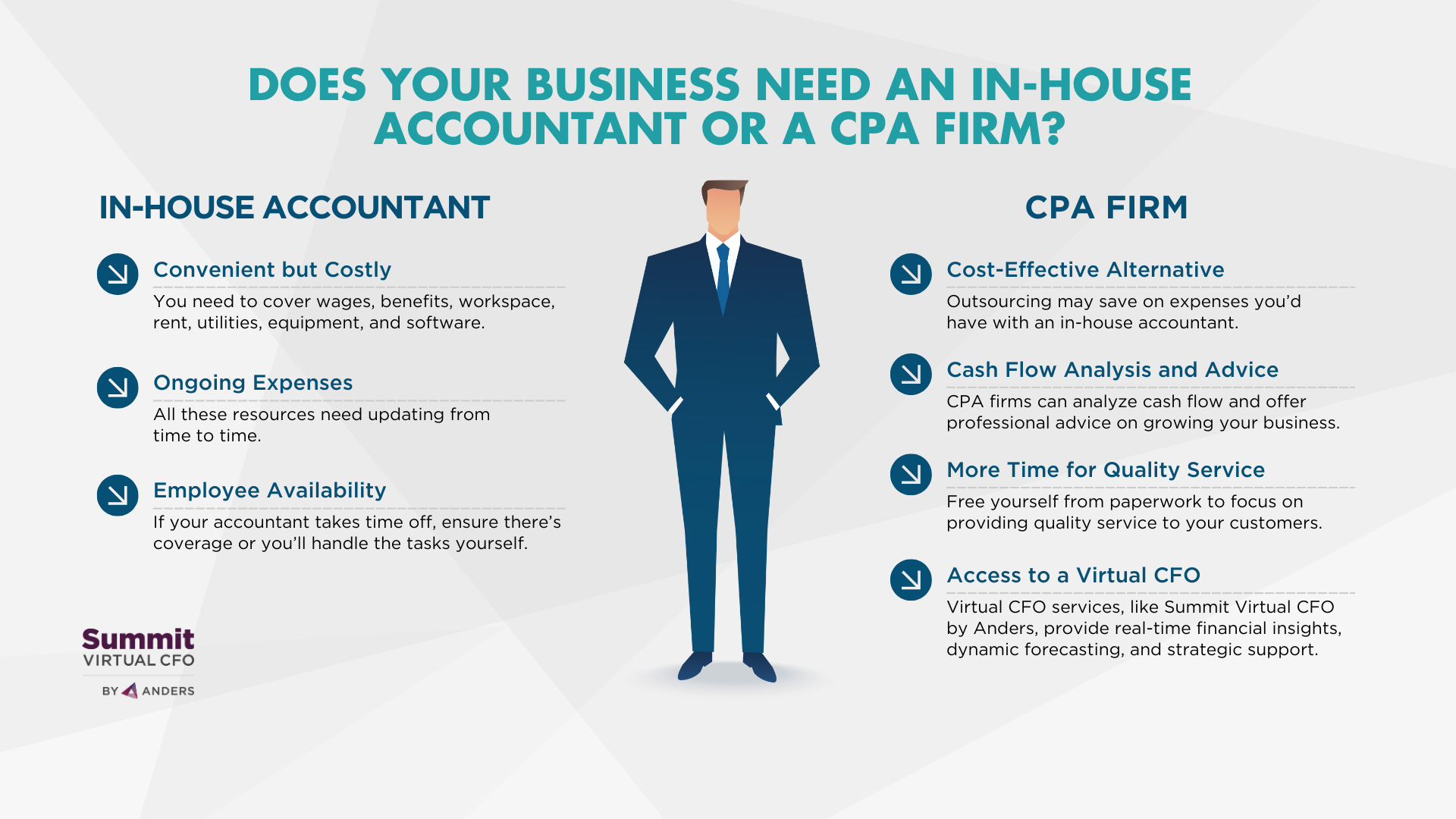

CPAs are the" large guns "of the audit industry and normally do not take care of daily accountancy jobs. You can guarantee all your funds are present which you remain in excellent standing with the internal revenue service. Hiring a bookkeeping firm is an obvious selection for complex companies that can afford a licensed tax obligation expert and an excellent option for any kind of local business that wishes to minimize the possibilities of being examined and unload the burden and migraines of tax obligation filing. Open up rowThe difference between a certified public accountant and an accountant is simply a legal distinction. A CPA is an accountant licensed in their state of procedure. Just a certified public accountant can provide attestation solutions, act as a fiduciary to you and offer as a tax lawyer if you deal with an internal revenue service audit. No matter of your situation, also the busiest accounting professionals can relieve the time problem of submitting your tax obligations on your own. Jennifer Dublino added to this post. Source meetings were performed for a previous version of this short article. Accounting business might also use CPAs, but they have various other types of accountants on staff. Often, these other kinds of accounting professionals have specialties throughout locations where having a CPA permit isn't required, such as monitoring audit, not-for-profit bookkeeping, cost audit, government accounting, or audit. That does not make them less certified, it just makes them in a different way certified. In exchange for these more stringent laws, Certified public accountants have the lawful authority to sign audited financial declarations for the objectives of approaching investors and safeguarding financing. While bookkeeping firms are not bound by these very same regulations, they have to still stick to GAAP(Typically Accepted Audit Concepts )best techniques and exhibit highhonest standards. Therefore, cost-conscious tiny and mid-sized companies will commonly make use of a bookkeeping services business to image source not just This Site meet their bookkeeping and accountancy needs now, yet to scale with them as they grow. Do not allow the viewed eminence of a company complete of CPAs distract you. There is a misconception that a certified public accountant firm will do a much better job since they are legitimately allowed to

embark on even more tasks than an accounting firm. And when this holds true, it doesn't make any kind of feeling to pay the premium that a certified public accountant firm will certainly charge. Organizations can conserve on expenses substantially while still having actually premium work official site done by using an accountancy services company instead. As a result, utilizing a bookkeeping services business is usually a much better value than employing a CERTIFIED PUBLIC ACCOUNTANT

Frost Pllc - The Facts

CPAs additionally have competence in establishing and perfecting business policies and treatments and assessment of the useful demands of staffing models. A well-connected Certified public accountant can leverage their network to aid the organization in various calculated and speaking with duties, successfully connecting the organization to the suitable candidate to fulfill their requirements. Following time you're looking to load a board seat, consider getting to out to a CPA that can bring value to your organization in all the ways listed above.